Seize the Opportunity!

Ready to Build Wealth, Power, and Purpose?

Join thousands who are shaping the future of finance through Kush National Bank — where your vision meets powerful solutions, global reach, and royal service.

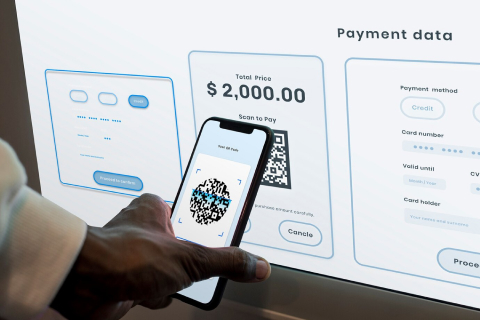

💼 Open Your Account

Tap into modern banking designed for individuals, businesses, and nations.

💳 Access Capital

Apply for funding — from microloans to multi-million dollar investments.

🧾 Simplify Your Finances

Send money, pay bills, and manage it all in one secure platform.

👑 Bank the Kush Way.

🔗 Open an Account Now

🔗 Apply for a Loan

🔗 Schedule a Consultation

🔗 Log In to Your Account

Your future. Your finances. Your Kingdom.